London Southend Airport & Environs Joint Area Access Plan (JAAP)

5. Implementation and Delivery Plan

For each project the schedules set out in this chapter:

- outline relevant JAAP policies;

- provide site background information;

- summarise the core infrastructure required to deliver the policies;

- consider the risks to delivery;

- identify mitigation measures;

- suggest potential delivery mechanisms; and

- propose suitable monitoring indicators.

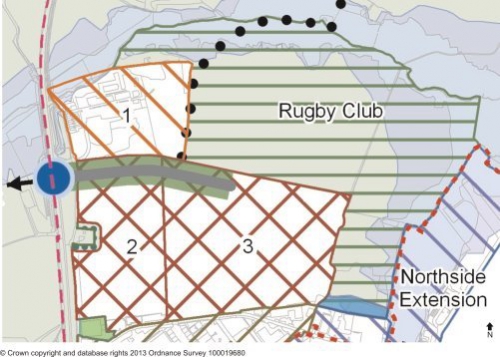

Key JAAP Project 1: Saxon Business Park

Figure 5.1 Saxon Business Park: Proposals Map Extract

3

The JAAP allocates land to accommodate up to 99,000 square metres of new employment space located north of Aviation Way and east of Cherry Orchard Way in an area to be known as Saxon Business Park. The allocation will accommodate up to 5,450 additional jobs in the area to 2021, and beyond. The proposed JAAP phasing and floorspace breakdown is as follows:

Table 5.1 Saxon Business Park Proposals

|

Area |

Use class |

Floorspace (sqm) |

Jobs |

|

Area 1 |

B1 |

20,000 |

1,000 |

|

Area 3 |

B1 and B2 |

49,000 |

2,450 |

|

Area 2 |

B1and B2 |

30,000 |

1,500 |

|

|

|

|

|

Project 1a: Saxon Business Park

|

Project 1a |

Saxon Business Park: Area 1 |

|||||

|

JAAP Policy |

Core Policies: E3 –Saxon Business Park E4 – Development of Area 1 Saxon Business Park Linked Policies: ENV1 – Revised Green Belt Boundary ENV2 – New Public Open Space – North ENV4 – Country Park: Access & Facilities ENV5 – Green Corridor to Business Park T3 –Travel Planning T4 - Public Transport T5 - Walking & Cycling T6 - Freight and Network Management T7 - Network Capacity Improvements |

|||||

|

Infrastructure improvements |

|

|||||

|

Risks & Mitigation See also summary risks table in Conclusion |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Risk Score |

||

|

|

Probability |

Impact |

|

Probability |

Impact |

|

|

The land is in two different ownerships and is subject to tenancies which could cause complexities for bringing forward the development in the short term. |

Medium |

High |

Ensure early and effective engagement with the landowners to ensure willingness to bring the site forward in the short term and for employment use as per JAAP |

Low |

Medium |

|

|

|

|

|

|

|

|

|

|

Potential contamination, archaeology and environmental issues may lead to significant remediation costs affecting scheme viability and ability to pay onerous S106 contributions. It is suggested an environmental and geo-technical assessment is carried out in due course to determine extent of any residual environmental works required alongside likely remediation costs. Cherry Orchard Homes & Villages plc has stated that should they progress with sale of the land from Hanson, they will cover the costs of any remediation required. Whilst they are willing to accept these environmental costs, any significant or unreasonable S106 costs on top of these may affect the overall scheme viability and there is a risk the developer may not proceed with the site. |

High |

High |

Whilst developer contributions can help provide important benefits to the wider area, it is important to ensure the collective S106/CIL monies and commitments required are not so onerous as to render schemes unviable; particularly on complex brownfield sites which may be costly to remediate. Once all costs are known across the JAAP area a developer contribution assessment will be undertaken to determine reasonable developer contributions or each infrastructure theme whilst considering site-specific issues such as contamination, infrastructure and remediation, and that a pragmatic approach is taken to archaeology. |

Low |

Low |

|

|

|

|

|

|

|

|

|

|

Lack of demand for increased employment provision within the JAAP area. Although this is more likely to be a risk as subsequent phases come forward, it is a risk for the provision of any new floorspace that comes onto the market. Evidence suggests that demand for new employment provision is likely to match supply as the Airport increases its capacity, although it is important that the demand for space is at a pricing level which will encourage and facilitate development. |

Medium |

High |

It is suggested that SBC and RDC monitor employment demand through updates to their Monitoring Reports (see below for suggested indicator) and ensure that Employment Land reviews are updated when necessary. If it becomes apparent there is an oversupply of employment land, a decision may need to be made to stagger or reduce the amount of land that goes on the market at any one time. It will also be important to ensure a strong Marketing Strategy is prepared for Saxon Business Park and implemented. |

Low |

High |

|

|

|

|

|

|

|

|

|

|

Delivery Mechanism & Delivery Bodies |

The brickworks site may be brought forward by a private developer. Currently Cherry Orchard Homes & Villages plc has an option on the land. An effective S106 agreement will ensure infrastructure is delivered to the requirements of the JAAP, however it is yet to be determined whether the estate road will be provided by SBC or will be a requirement on the developer. It is proposed a partnership-led steering group is tasked with preparing a masterplan in the short term along with a number of assessments to inform future direction, including potentially transport and flood-risk/ surface water to enable a strategic, site-wide masterplan for the entire Saxon Business Park. This will be supported by a design brief to ensure an appropriately high quality, sustainable scheme is brought forward along with guidance for developers outlining planning application and S106 requirements. Whilst the public sector i.e. SBC & RDC will lead this masterplan and assessment work, the buy-in and support of private sector interests and statutory undertakers will be vital. Essex County Council and Southend-on-Sea Borough Council will work jointly to undertake further transport modelling and assessment work across the JAAP area. |

|||||

|

Suggested Monitoring Indicators |

Preparation of Masterplan & Design Brief Access and number of metres of estate road in place (if progressed) Sq. m of employment floorspace provided Number of months new units are on the market before take up (will assist in monitoring demand for new employment provision) Number of jobs provided Number of metres of footpaths and cyclepaths Number of employees travelling by means other than the car Travel Plan(s) in place |

|||||

Project 1b: Saxon Business Park – Area 3

|

Project 1b |

SaxonBusiness Park: Area 3 |

|

JAAP Policy |

Core Policies: E3 –Saxon Business Park E4 – Development of Area 1 Saxon Business Park Linked Policies: ENV1 – Revised Green Belt Boundary ENV2 – New Public Open Space – North ENV4 – Country Park: Access & Facilities ENV5 – Green Corridor to Business Park T3 –Travel Planning T4 - Public Transport T5 - Walking & Cycling T6 - Freight and Network Management T7 - Network Capacity Improvements |

|

Infrastructure improvements |

|

|

Risks & Mitigation See also summary table in conclusion |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Risk Score |

||

|

|

Probability |

Impact |

|

Probability |

Impact |

|

|

IPECO decides to relocate elsewhere and does not proceed with development at Saxon Business Park. IPECO's interest is a boost to the deliverability of Saxon Business Park in the short term. IPECO has indicated they are keen to remain in the vicinity of London Southend Airport if possible. |

Medium |

Medium |

SBC continue to engage with IPECO to help facilitate purchase and transition to new premises in Saxon Business Park. The balance of the land should also be marketed effectively to other potential investors. Evidence suggests that there is likely to be sufficient demand for employment provision within the JAAP area – it is likely that other companies will locate to Saxon Business Park in due course. |

Low |

Medium (short term only) |

|

|

|

|

|

|

|

|

|

|

Lack of demand for increased employment provision within the JAAP area. Whilst it is apparent IPECO are keen to relocate, market interest is yet to be determined for any balance of land. |

Medium |

High |

It is suggested that SBC and RDC monitor employment demand through updates to their Monitoring Reports (see below for suggested indicator) and regular updates to their Employment Land reviews. If it becomes apparent there is an oversupply of employment land, a decision may need to be made to stagger or reduce the amount of land that goes on the market at any one time. It will also be important to ensure a strong Marketing Strategy is prepared for Saxon Business Park and implemented. |

Low |

High |

|

|

|

|

|

|

|

|

|

|

Onerous S106 agreements may affect the viability of proposals possibly preventing developers from progressing with development on site. Whilst developer contributions can help provide important benefits to the wider area, it is important to ensure the collective S106 monies required are not so onerous as to render schemes unviable. |

Medium |

High |

Once all costs are known across the JAAP area a developer contribution assessment should be undertaken to determine reasonable developer contributions for each infrastructure theme whilst considering site-specific issues such as contamination. |

Low |

Low |

|

|

Delivery Mechanism & Delivery Bodies |

SBC as owners of the land are likely (to be finally determined) to put in the necessary enabling works including the new road and then sell Area 3 off in a number of land parcels. IPECO currently have an interest in approximately 8ha (2/3rds) of the site. Other interests are expected to come forward once SBC market the site. An effective S106 agreement will ensure infrastructure is delivered to the requirements of the JAAP. It is proposed a partnership-led steering group is tasked with preparing a masterplan in the short term along with a number of assessments to inform future direction, including potentially transport and flood-risk/ surface water to enable a strategic, site-wide masterplan for the entire Saxon Way Business Park. This will be supported by a design brief to ensure a high quality, sustainable scheme is brought forward along with guidance for developers outlining planning application and S106 requirements. Whilst the public sector i.e. SBC and RDC could lead this masterplan and assessment work, the buy-in and support of private sector interests and statutory undertakers will be vital. Essex CC and SBC will need to work jointly to undertake further transport modelling and assessment work. |

|||||

|

Suggested Monitoring Indicators |

Preparation of Masterplan & Design Brief |

|||||

Project 1c: Saxon Business Park – Land at Area 2 Westcliff Rugby Club

|

Project 1c |

Saxon Business Park: Land at Area 2 Westcliff Rugby Club |

|||||

|

JAAP Policy |

Core Policies: E3 – Saxon Business Park E5 – Development of Area 3 Saxon Business Park ENV2 – New Public Open Space - North Linked Policies: ENV1 – Revised Green Belt Boundary ENV4 – Country Park; Access & Facilities ENV5 – Green Corridor to Business Park T3 - Travel Planning T4 - Public Transport T5 - Walking & Cycling T6 - Freight and Network Management T7 - Network Capacity Improvements |

|||||

|

Infrastructure improvements requiring funding |

Cherry Orchard Jubilee Country Park Environment & Visitor Centre

NB: whilst policy E3 states that contributions to the above will be required for all phases of the business park, it is likely that post 2021 most of the infrastructure elements will be in place, the key infrastructure requirement is therefore the relocation of the rugby club to an appropriate standard. |

|||||

|

Risks & Mitigation See also summary risks table in conclusion |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Risk Score |

||

|

|

Probability |

Impact |

|

Probability |

Impact |

|

|

Lack of demand for increased employment provision within the JAAP area. As the site will be brought forward post-2021 it is not possible to predict likely market demand for employment provision at Area 3 at this stage, however, it is expected that with key infrastructure in place, a number of new businesses already established in Saxon Business Park, and the airport reaching 2million passengers per annum, demand will be sufficient and values suitable to ensure viability and encourage investment.. |

Medium |

Medium (by 2021) |

It is suggested that SBC and RDC monitor employment demand through updates to their Monitoring Reports (see below for suggested indicator) and regular updates to their Employment Land reviews. If it becomes apparent there is an oversupply of employment land, a decision may need to be made to stagger or reduce the amount of land that goes on the market at any one time. It will also be important to ensure a strong Marketing Strategy is prepared for Saxon Business Park and implemented. |

Low |

Medium (by 2021) |

|

|

|

Onerous S106 agreements may affect the viability of proposals possibly preventing developers from progressing with development on site. Whilst developer contributions can help provide important benefits to the wider area, it is important to ensure the collective S106 monies required are not so onerous as to render schemes unviable. |

Medium |

High |

Once all costs are known across the JAAP area a developer contribution assessment should be undertaken to determine reasonable developer contributions for each infrastructure theme whilst considering site-specific issues |

Low |

Low |

|

Delivery Mechanism & Delivery Bodies |

One option is for SBC as owners of the land to put in the necessary enabling works including the new road, and then sell Area 2 off in a number of land parcels once the rugby club has been relocated. Developer interests are expected to come forward once SBC market the site. An effective S106 agreement will ensure infrastructure is delivered to the requirements of the JAAP. Realistic contributions post 2021 are likely to include: public open space, contributions to footpaths and cycleways, and public transport provision. It is proposed a partnership-led steering group is tasked with preparing a masterplan in the short term along with a number of assessments to inform future direction, including potentially transport and flood-risk/ surface water to enable a strategic, site-wide masterplan for the entire Saxon Business Park. This will be supported by a design brief to ensure a high quality, sustainable scheme is brought forward along with guidance for developers outlining planning application and S106 requirements. Whilst the public sector i.e. SBC & RDC could lead this masterplan and assessment work, the buy-in and support of private sector interests will be vital. Essex CC and SBC will need to work jointly to undertake further transport modelling and assessment work. |

|||||

|

Suggested Monitoring Indicators |

Rugby Club relocation |

|||||

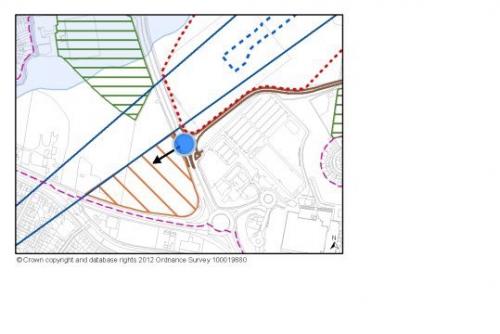

Key JAAP Project 2: Nestuda Business Park

The site at Nestuda Way is situated in a prime location with good accessibility to the major road network. It lies on the corner of Prince Avenue (A127) and Nestuda Way and is currently open land which falls adjacent to the Airport runway public safety zone. This site is owned by Southend Borough Council and is identified to provide 10,000 sqm of B1 Office Use in Phase 2 and create 500 new jobs. The design of the building would need to accord with the height limitations set due to its proximity to the Airport Runway Public Safety Zone.

Figure 5.2 Nestuda Business Park: Proposals Map Extract

|

Nestuda Way Business Park |

||||||

|

JAAP Policy |

Core Policies: Policy – E7 - Nestuda Way Business Park Policy – LS3 – Public Safety Zones Linked Policies: Policy - E1 - General Development Considerations Policy - T4- Public Transport Policy - T5 – Walking & Cycling Policy - T3 – Travel Planning T6 - Freight and Network Management T7 - Network Capacity Improvements |

|||||

|

Infrastructure improvements requiring funding |

|

|||||

|

|

|

|

||||

|

Risks & mitigation See also summary risks table in conclusion |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Impact |

||

|

|

|

|

|

|

|

|

|

Lack of demand for increased employment provision within the JAAP area. As the site is programmed to be brought forward post-2021 it is not possible to predict likely market demand for employment provision at Nestuda Way at this stage, however, it is to be hoped that with key infrastructure in place, a number of new businesses already established in Saxon Business Park, and the airport reaching 2million passengers per annum, demand will be achieved. The site is also in an excellent location at the junction of the A127 and B1031. |

Medium |

Medium (by 2021) |

It is suggested that SBC and RDC monitor employment demand through updates to their Monitoring Reports (see below for suggested indicator) and regular updates to their Employment Land reviews. If it becomes apparent there is an oversupply of employment land, a decision may need to be made to stagger or reduce the amount of new land that goes on the market at any one time. |

Low |

Medium (by 2021) |

|

|

|

|

|

|

|

|

|

|

Onerous S106 agreements may affect the viability of proposals possibly preventing developers from progressing with development on site. Whilst developer contributions can help provide important benefits to the wider area, it is important to ensure the collective S106 monies required are not so onerous as to render schemes unviable. |

Medium |

High |

Once all costs are known across the JAAP area a developer contribution assessment may be undertaken to determine reasonable developer contributions for each infrastructure theme whilst considering site-specific issues such as contamination. |

Low |

Low |

|

|

Delivery Mechanism & Delivery Bodies |

The site is owned by SBC. SBC anticipate enabling works being put in place prior to marketing the site to a developer. |

|||||

|

Suggested Monitoring Indicators |

Sq. m of employment floorspace provided |

|||||

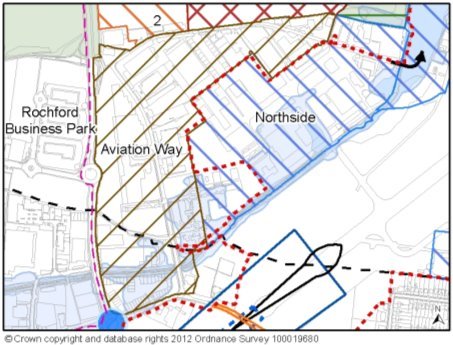

Key JAAP Project 3: Aviation Way

Aviation Way has been allocated in the JAAP to provide an additional 15,000sq.m of additional B1/B2 floorspace accommodated from the intensification of the existing Aviation Way Industrial Estate.

Figure 5.3 Aviation Way: Proposals Map Extract

|

AviationWayBusinessPark |

||||||

|

JAAP Policy |

Core Policies: Policy E2 - Aviation Way Industrial Estate Policy T1 – Access to Development Areas Policy MRO1 - Northern MRO Policy MRO2 - Northern MRO Extension Linked Policies: Policy ENV2 - New Public Open Space North Policy T3 - Travel Planning T5 - Walking & Cycling T6 - Freight and Network Management T7 - Network Capacity Improvements |

|||||

|

Infrastructure improvements requiring funding |

|

|||||

|

|

|

|

||||

|

Potential Risks & Mitigation |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Risk Score |

||

|

|

Probability |

Impact |

|

Probability |

Impact |

|

|

Lack of demand for new and increased employment provision within Aviation Way. Although the employment area is already established, there are current vacant land plots and a number of units have yet to be taken up by the market. Whilst it is anticipated the market will improve in the medium to long term, Aviation Way may struggle to attract new tenants with higher profile business space provided in very close proximity at Saxon Business Park. |

Medium |

High |

SBC and RDC will monitor employment demand through their Monitoring Reports (see below for suggested indicator) and regular updates to their Employment Land reviews. If it becomes apparent there is an oversupply of employment land, a decision may need to be made to stagger or reduce the amount of new land that goes on the market at any one time. It will also be important to ensure Aviation Way has its own Marketing Strategy to attract its target tenants/ investors. This could potentially be an early action of a Business Improvement District (see below). |

Low |

Medium |

|

|

|

|

|

|

|

|

|

|

As Aviation Way is an established employment area with only a limited number of sites likely to be redeveloped, S106 contributions may be limited creating funding difficulties for estate wide improvements and road/ junction upgrade. In turn, this may impact on the marketability of new employment provision. |

High |

High |

Obtain funds from existing leaseholders/ freeholders under current covenant agreement or investigate other means of delivery such as establishment of a BID. Funds may also be available from Essex County Council who may progress with the adoption of the road. |

Medium |

Medium |

|

|

|

|

|

|

|

|

|

|

High flood risk designation may prevent MRO Northern Extension coming forward in the short to medium term. As an area of high flood risk, the MRO Northern Extension will be subject to sequential testing prior to any application approval. The Environment Agency as a statutory consultee may object and recommend refusal for any proposals within the MRO Northern Extension area whilst vacant sites exist within Aviation Way. This may reduce the likelihood of the Airport extending their MRO operations in the short term. In turn, as the MRO extension area is likely to be the subject of the largest single planning application and S106 agreement, funds for extension and upgrade of Aviation Way estate road and the public open space to the west may be stalled until existing smaller sites are developed out within Aviation Way. |

Medium |

High |

The Airport should engage early and effectively with the Environment Agency to ensure appropriate flood management solutions and compensatory floodplain storage is provided as part of any future planning application(s). RDC and SBC should support the Airport through this process as required. NB: In December 2009 Atkins was commissioned to undertake a sequential test of the JAAP, the report confirmed that there are no alternative sites at less risk of flooding that can reasonably considered, however individual applicants will be required to demonstrate appropriate measures are put in place to further reduce flood risk. |

Low |

High |

|

|

Delivery Mechanism & Delivery Bodies |

A Business Improvement District (BID) could be established. BIDs are defined areas within which businesses pay an additional tax or fee in order to fund improvements within the set boundaries. BIDs are democratic bodies established through a formal ballot which must achieve a majority in terms of number of ratepayers and percentage of rateable value. Once voted in, BIDs work on the principle of an additional mandatory levy on all defined ratepayers, collected in the same way as the Business Rate. This provides a ring-fenced budget for exclusive use in the immediate environment. Further funds can be leveraged against this core funding for added value. The BID, working closely with SBC and RDC, could jointly prepare an Aviation Way Improvement Scheme which would outline all measures required to improve the area and maximise development potential within the estate. Once all costs have been defined, a fund could be set up to deliver the improvements over time. Collation of S106 monies for upgrade where possible. Potential to utilise maintenance fee from covenants. |

|||||

|

Suggested Monitoring Indicators |

Establishment of BID or alternative arrangement Number of sq. m of new floorspace created Number of months new units are on the market before take up (will assist in monitoring demand for new employment provision) Number of new jobs provided Number of metres of upgraded road in place. Provision of footpaths/ cycleways Travel Plan(s) in place |

|||||

Key JAAP Project 4: Airport Development

The JAAP sets out a policy framework to support the development of London Southend Airport to grow to a capacity of up to 2 million passengers per annum through an extension of the runway alongside the development of the new railway station, terminal and aircraft handling facilities. Whilst the airport expansion will be used primarily for passengers supporting a number of Fixed Based Operators, the JAAP also anticipates that the airport will see growth in its maintenance, repair and overhaul facilities (MRO) supporting the provision of a range of high skilled jobs in the area. There is therefore policy provision for both elements of airport development.

Figure 5.4 London Southend Airport: Proposals Map Extract

|

Airport Development |

||||||

|

JAAP Policy |

Core Policies: Policy LS1 – General Policy Policy LS2 – Development at London Southend Airport Policy TF1 – Expansion of New Terminal. Policy MRO1 – Northern MRO Policy MRO2 – Northern MRO Extension Policy MRO3 – Southern MRO Zone Policy ADZ1 – Existing terminal area Linked Policies: Policy LS3 – Public Safety Zones Policy E2 - Aviation Way Industrial Estate Policy T1 – Access to development Areas Policy T3 – Travel Planning Policy T4 – Public Transport Policy T5 – Walking & Cycling Policy T6 - Freight and Network Management Policy T7 - Network Capacity Improvements Policy ENV2 – New Public Open Space North |

|||||

|

Infrastructure improvements requiring funding |

|

|||||

|

|

|

|

||||

|

Potential Risks & Mitigation |

Risk & Impact |

Initial Risk Score |

Suggested Mitigation |

Residual Risk Score |

||

|

|

Probability |

Impact |

|

Probability |

Impact |

|

|

|

|

|

|

|

|

|

|

High flood risk designation may prevent MRO Northern Extension coming forward in the short to medium term As an area of high flood risk, the MRO Northern Extension will be subject to sequential testing prior to any application approval. The Environment Agency as a statutory consultee may object and recommend refusal for any proposals within the MRO Northern Extension area whilst vacant sites exist within Aviation Way. This may reduce the likelihood of the Airport extending their MRO operations in the short term. In turn, as the MRO extension area is likely to be the subject of the largest single planning application and S106 agreement, funds for extension and upgrade of Aviation Way estate road and the public open space to the west may be stalled until existing smaller sites are developed out within Aviation Way. |

Medium |

High |

The Airport should engage early and effectively with the Environment Agency to ensure appropriate flood management solutions and compensatory floodplain storage is provided as part of any future planning application(s). RDC and SBC should support the Airport through this process as required. NB: In December 2009 Atkins was commissioned to undertake a sequential test of the JAAP, the report confirmed that there are no alternative sites at less risk of flooding that can reasonably considered, however individual applicants will be required to demonstrate appropriate measures are put in place to further reduce flood risk. |

Low |

High |

|

|

Issue: The MRO Northern Extension is an area of high flood risk and will be subject to sequential testing prior to any application approval. The Environment Agency as a statutory consultee may object and recommend refusal for any proposals within the MRO Northern Extension area whilst vacant sites exist within Aviation Way. This may reduce the likelihood of the Airport extending their MRO operations in the short term. In turn, as the MRO extension area is likely to be the subject of the largest single planning application and S106 agreement, funds for extension and upgrade of Aviation Way estate road and the public open space to the west may be stalled until existing smaller sites are developed out with Aviation Way. By this stage, the road is likely to be stretched beyond capacity. |

Medium to High Risk |

|||||

|

Delivery Mechanism & Delivery Bodies |

London Southend Airport Ltd will deliver all airport-related works and associated infrastructure including requirements through S106 which will benefit the JAAP area as a whole. MRO northern extension area to potentially form part of a BID as obvious links through Aviation Way. (See Chapter 5 - Key JAAP Project 3 for more information). |

|||||

|

Suggested Monitoring Indicators |

Annual passenger through-put at Airport Sq. m of additional MRO employment floorspace provided Number of jobs provided Number of metres of footpaths and cyclepaths Airport contribution to public transport Percentage of passengers arriving at airport by non-car modes Percentage of employee arriving at airport by non-car modes |

|||||